Keeping IP under lock and key

This month's Intellectual Property (IP) news highlights the importance and challenges of protecting core patents, trademarks and trade secrets. We examine the impact a security breach can have in IP-driven sectors and catch up on some updates to previous stories on the safeguarding of intangibles.

Et tu, Employee? Industrial espionage and IP

In their annual report published this month, technology giant ASML revealed that it had experienced "unauthorized misappropriation of data relating to proprietary technology by a (now) former employee in China."

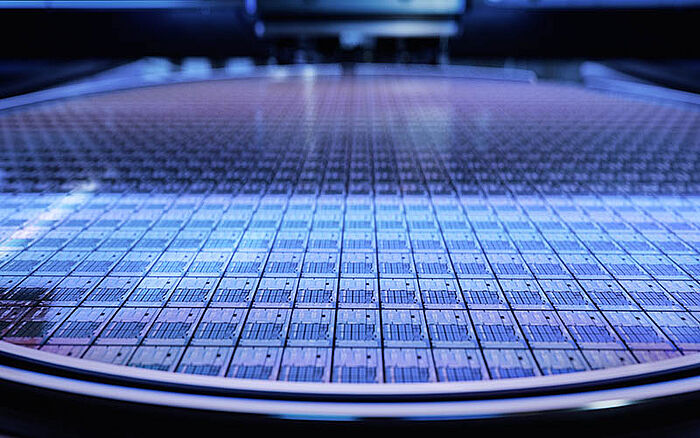

The Dutch company is the world's only supplier of extreme ultraviolet (EUV) lithography machines to the semiconductor industry. In turn, these devices are essential to the manufacture of the most advanced microchips from companies such as Intel and TSMC. However, strict Dutch export controls – with the endorsement of the United States – forbid the delivery of EUV machines to China. Sole ownership of this extremely valuable IP helped propel ASML's net sales to an incredible €21.2 billion in 2022, itself a massive return on a research and development budget of €3.3 billion.

Though ASML has not confirmed what the misappropriated data referred to, the company ostensibly ruled out a relation to EUV technology by stating in its report that it does not believe the information was material to its business. Nevertheless, "certain export control regulations may have been violated," demonstrating vulnerabilities in data protection and the necessity for secure contracts and other agreements such as non-disclosure agreements (NDAs).

Such legal measures are essential when an employee has access to trade secrets or other highly sensitive IP assets. Not only are physical or software security processes required to protect relevant data, but the owner / originator of a trade secret is obliged to defend the confidentiality of their information in order to uphold its status as this kind of IP.

With each machine carrying a pricetag of €100 million, it is easy to see why EUV lithography has been described as "one of the most complex technologies ever developed." The EUV light that traces out microchip structures is emitted by heating a drop of tin with a laser to 200,000°C – 50,000 times a second!

Whether data involves a trade secret or an unpublished patent, disclosure of business-central information can have massive financial repercussions. As mentioned, the exclusivity of EUV technology and its keystone position within the semiconductor industry elevate its already substantial value.

Following this recent scare, ASML is redoubling internal security efforts to keep valuable data out of the hands of unscrupulous actors and overly ambitious employees and ensure its trade secrets stay secret.

Trials of a vaccine patent: UK court date for Moderna vs. Pfizer / BioNTech

Last September, we reported on Moderna's patent infringement lawsuits for COVID-19 vaccines against Pfizer and its German partner BioNTech. Moderna is pursuing legal action in several venues, including in the United States, Germany and the Netherlands, over the alleged infringement of patented messenger RNA (mRNA) technology in developing the Comirnaty vaccine. In response, Pfizer and BioNTech are countersuing in the United States.

As part of this wider, multi-billion-dollar dispute, the United Kingdom High Court recently announced that the trial in that country will begin in April 2024.

At the heart of the dispute are the mRNA technique used to create the Spikevax (Moderna) and Comirnaty (Pfizer and BioNTech) vaccines. In the body, mRNA functions to encode and transfer genetic information within cells, hence "messenger." When the vaccine is introduced into the patient, it functions as a data packet, exploiting the normal cellular processes to lead to the production of viral spike proteins.

By this mechanism, both vaccines "fool" the body into producing these harmless chemical identifiers, or "antigens," otherwise associated with a target virus. In turn, these antigens trigger a response from the immune system. It is this simulated reaction that causes symptoms such as nausea and headache rather than the mRNA vaccine or even the antigens. Later, a memory of the antigen is retained to allow a faster, more effective immune response when exposed to an actual coronavirus.

Unlike the more familiar double-helical profile of DNA, mRNA consists of only a single strand of unpaired nucleotides. This open-ended framework creates attachment points for other cellular structures that carry particular amino acids. Arranged in the correct sequence, these amino acids form a new protein.

As the global threat subsides and government purchases of COVID-19 vaccines shrink, both Moderna and Pfizer report that they expect sales to plummet from the highs seen in 2022. Notwithstanding, Moderna anticipates Spikevax to generate revenue of $5 billion USD this year, underscoring the immensity of any potential damages from patent infringement.

The COVID-19 pandemic was a litmus test for the patent system regarding the availability of pharmaceuticals. Though debate will undoubtedly continue for many years, the existing IP structure has been largely effective at delivering essential vaccines in short order while protecting the rights of developers. After all, public disclosure of knowledge is a central tenant of patenting.

All that being said, following a voluntary moratorium on asserting its IP rights, Moderna contends that it is time for rival pharmaceutical companies to pay the piper. And with so much at stake in multiple jurisdictions, we will be listening very closely to what tune the courts play.

Digital purse-snatcher: Hermès shuts down METABIRKINS NFTS

On February 8, French design house Hermès won its trademark infringement lawsuit against digital artist Mason Rothschild over the sale of "METABIRKINS" non-fungible tokens (NFTs). After a six-day trial, a jury at the Southern District Court of New York found in favor of the luxury goods company and recommended a damages award of $133,000 USD.

The final judgment from Senior Judge Jed S. Rakoff found Rothschild "liable on the claims of trademark infringement, trademark dilution, and cybersquatting."

Luxury handbags are seen as an attractive financial investment, recently surpassing art and similar collectibles in value appreciation. But as this count of cybersquatting suggests, famous brands could soon be creating digital assets to expand the reach of their most desirable trademarks.

According to The New York Times, Rothschild estimated his proceeds to have been $125,000 USD from NFTs connected to images of so-called "METABIRKIN" handbags. All the same, his defense hinged on First Amendment protections for speech, likening his representations of the trademarked Birkin bags to Andy Warhol's silk-screen prints of Campbell's soup cans. The jury, however, disagreed that the NFTs were purely artistic statements on the absurdity of luxury goods, finding that there was a likelihood of confusion with products originating from Hermès.

As reported in court documents, Hermès has generated over $1 billion USD from Birkin handbags in the United States alone since 1986, with the last ten years contributing over $100 million USD. On top of this market influence, "both parties recognize[d], the Birkin bag has also come to occupy a place of cultural importance as a symbol of wealth and exclusivity." Though Judge Rakoff refused to issue a summary judgment on whether the NFTs were commenting on or merely profiting from Hermès' brand image, the jury was clear in its conclusion: First Amendment protections did not bar liability for any of the three counts.

This judgment is likely to be highly precedential when it comes to establishing how NFTs and other novel digital assets interact with the existing IP framework. In this case, the trusty trademark, ever dependable and infinitely renewable, has shown that old is still gold.

Filed in

Explore the latest IP dramas, from an Olympic trademark dispute to challenges in drug patenting and a lawsuit for allowing music piracy.